When does your business need a W-9 from its vendors?

Do you know the rules regarding when you should request a W-9 from your vendors?

Many business owners don’t request a W-9 upfront, even though it’s a legal requirement to get one from each of the business’s vendors. The penalties for not issuing 1099s when required can quickly add up to a serious amount. Keep reading to learn more about what a W-9 is, its importance to your business and when you should request it.

What is IRS Form W-9?

Unlike when dealing with employees, there is normally no requirement for your business to pay income taxes to the government when paying vendors. The W-9 ( https://www.irs.gov/pub/irs-pdf/fw9.pdf and https://www.irs.gov › pub › irs-pdf) is the form which the IRS requires any business which makes payments to a vendor to obtain from that vendor. The W-9 form should be sent to the vendor for them to complete and sign. Once received, it should be filed and retained for at least three years after your trading relationship with the vendor ends – you do not have to send the form to the IRS.

Information required includes:

-

- Vendor’s name (per tax returns).

-

- Tax classification of vendor (LLC, partnership, etc.).

-

- Vendor’s address.

-

- Any applicable exemption codes.

-

- The vendor’s SSN or EIN (depending on tax classification).

When should you request the W-9?

Ask for the form before you put in your order – or at least before you part with any money – because the IRS requires you to withhold 24% “backup withholding” from your payment to any vendor who refuses to supply a completed W-9. Reminding any reticent vendors of this should be enough to get them to comply. Although, technically, W-9s do not expire, it’s good practice to request an updated form every two or three years to make sure your records are up to date and in case any of your vendors’ tax status has changed.

What’s next?

The purpose of collecting the information found on the W-9 is to help you decide whether your vendors need to receive a 1099 form, at the end of the tax year. This is an income tax form, sent to the vendor, the IRS and SSA in certain cases, informing them of money you have paid to your vendors. There are several types of 1099 (distinguished by their suffix), but the two you will most likely need to issue will be the 1099-NEC (Non-Employee Compensation) and the 1099-MISC.

Who gets one?

-

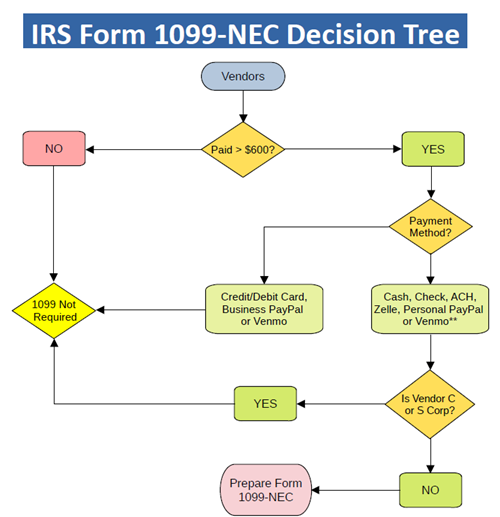

- Firstly, the general rule is that you only need to complete a 1099 for vendors whom you paid over $600 in the preceding calendar year. Exceptions include payments of royalties and certain broker payments, where the threshold is $10.

-

- Secondly, entities who file taxes as C and S corporations do not receive 1099s (with the exception of incorporated lawyers). You will send only to sole proprietors, single-member LLCs and partnerships.

-

- You do not need to send a 1099 to a vendor who was paid by a Payment Settlement Entity (PSE). These comprise:

-

-

- Debit card, credit card, gift card.

-

-

-

- Third-party payment networks such as payment apps (Venmo etc.) or online marketplaces.

-

These vendors will receive a 1099-K from the payer, if the total amount paid during the year exceeds $600.

** Best practice is to use only business Venmo and PayPal accounts for business purposes. If personal accounts are used for business, issue a 1099-NEC.

Gross proceeds to an attorney and rents paid are reportable on form 1099-MISC

When do you send the forms?

1099-NEC forms are due to the vendor and the IRS by January 31 of the following year. 1099-MISC forms should be received by March 31. Penalties for missing the deadlines add up very quickly and are calculated per form due/submitted. For 2023 (filed in 2024): 1-30 days late, $60 per form; more than 30 days but before August 2, $120; on or after August 2, $310; intentional neglect to file, $630 per form.

So, if you had 30 forms to file and you were tardy, the fine would range from $1,800 to $9,300. Serious money! In the unlikely event that you did not file at all, your penalty would be a whopping $18,900!

Deadlines and penalties may change from year to year.

Conclusion

As you can see, the cost to a small business for not following the rules can be severe and simply not having enough time to deal with it is not an excuse as far as the IRS are concerned. Make sure you have the situation covered by following up well before the end of the year and checking you have W-9s in place for all your vendors. Going forward, follow best practices and get a W-9 from all new vendors before you pay them any money. The responsibility for making sure this job is handled properly falls squarely on your shoulders as the business owner and you simply cannot afford to let it get away from you.

If you find you do not have the time, the staff or the confidence to get the job done before the IRS deadlines, pay a third party, such as a bookkeeping firm, to do it for you – it will cost a fraction of the penalties you’ll incur.